Quick CV Dropoff

Want to hear about the latest non-profit and public sector opportunities as soon as they become available? Upload your CV below and a member of our team will be in touch.

Our latest report below analyses data from the non-profit sector for:

For more information or if you have any questions about this report contact marketing@tpp.co.uk

The ONS reported a 1.3% drop in vacancies from March to May 2024 across all sectors, compared to the period before.

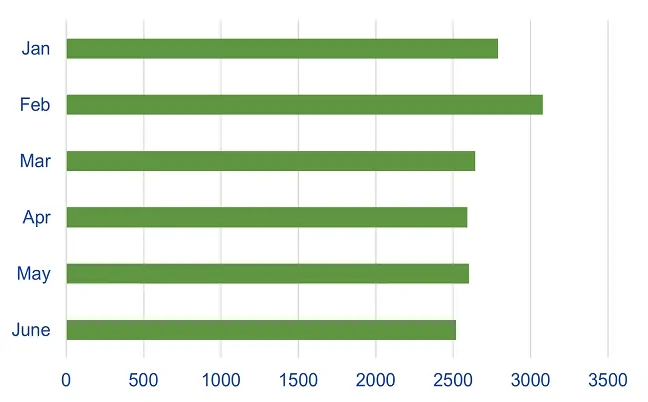

The 10% drop in job vacancies within the non-profit sector in Q2 of 2024 compared to Q1, signals a period of adjustment and reflection for the sector.

Some of the underlying causes range from economic factors, the general election and operational adjustments to seasonal trends. Another factor could be that organisations are focusing on optimising current resources rather than expanding the workforce.

By having an awareness of these fluctuations, non-profits can avoid this impacting on their ability to hire effectively to deliver the vital services and means that more careful strategic planning can take place.

Recruitment & Employment Confederations (REC) employment data reported a fall in permanent staff vacancies for a tenth successive month nationally across all sectors, but the demand for temporary workers was broadly unchanged.

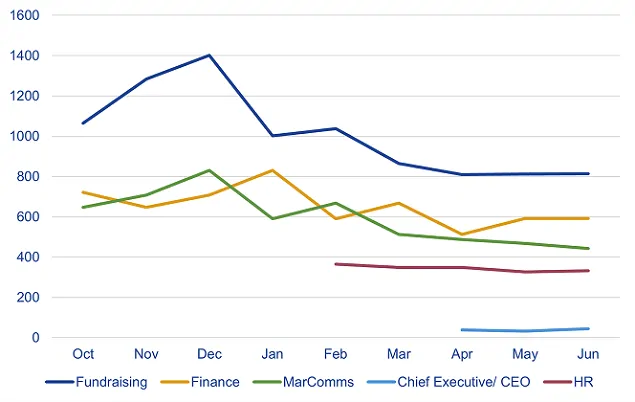

Live vacancy data has shown finance to have the biggest fluctuations during April to June 2024, with the majority of job functions remaining fairly steady, but lower than Q1 of 2024. Fundraising and marcomms & digital have seen a slight decline.

Since reporting fundraising vacancies have seen the biggest fluctuations and are currently at similar levels to 2020.

Data tracked here is for live vacancies within the non-profit sector advertised as permanent, temporary and fixed-term contract.

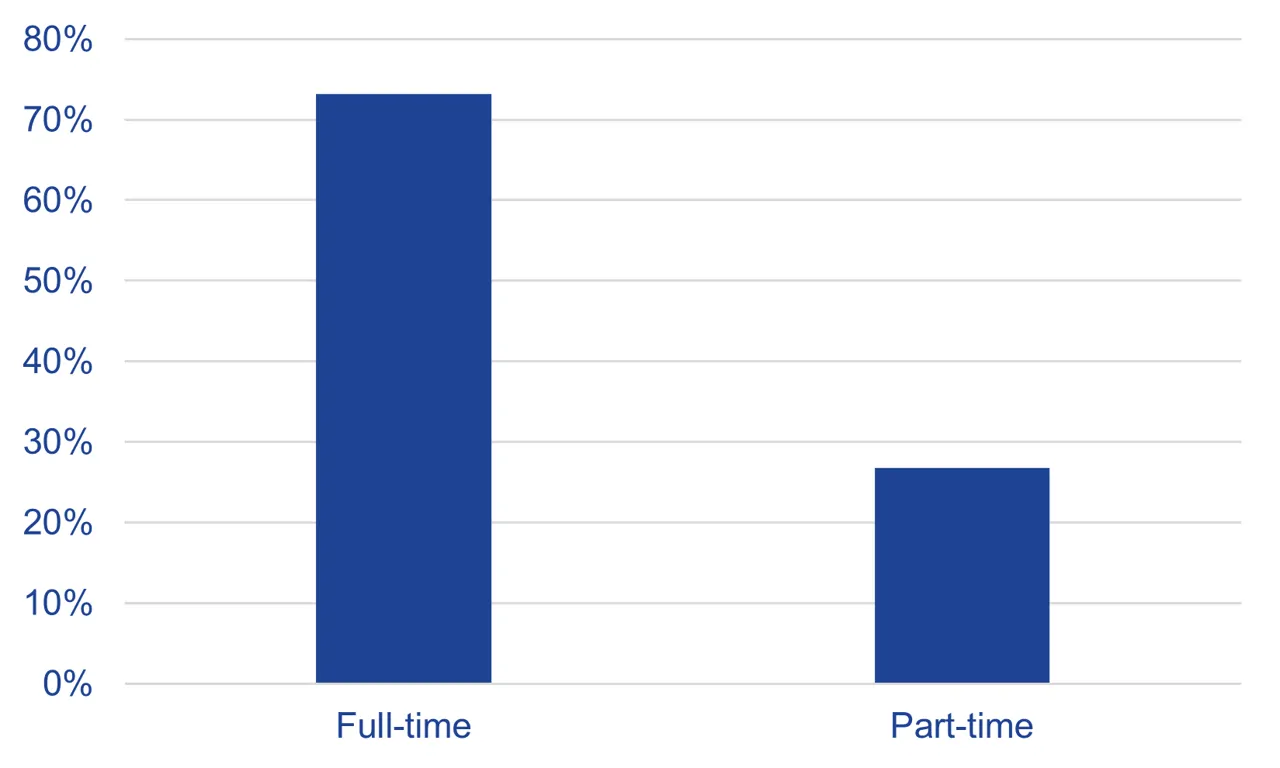

Despite the overall 10% drop in job numbers from Q1 to Q2, the distribution of job types among live vacancies remained consistent, which suggests that non-profits are maintaining a steady approach to their hiring practices.

By balancing permanent, contract, and temporary positions, and prioritising full-time roles, the sector can ensure continuity, adaptability, and the capacity to achieve critical outcome, even in the face of overall job market fluctuations. It should be noted however, that increasing the use of a contingent and flexible workforce, could provide much needed skills and experience at short notice, that fits in with budget constraints.

The data from January to June 2024 shows a clear preference in the non-profit sector for hybrid work arrangements, with a significant proportion of on-site roles and a smaller but consistent presence of fully remote positions.

Fully remote vacancies attract a signficantly higher number of applications, which indicates an ongoing demand from job seekers for remote working opportunities. Hybrid working continues to be attractive too, and a common requirement from job seekers.

Global averages (all countries/ sectors) are 60% hybrid, 24% fully remote & 17% office based, so the non-profit sector is not following this trend.

The number of live vacancies advertised as full-time and part-time has remained consistent for some time, regardless of market conditions.

On average, 11% of the live jobs advertised between April and June 2024 are entry level roles. This has marginally increased by 1% from early 2024.

With skills shortage faced by the many sectors, including the non-profit sector, it is increasingly important to attract entry level talent.

This will support with longer term sustainability of services, as well as improve overall productivity. Attracting entry level talent will help with providing a steady supply of new talent, which will plug skills gaps, foster stronger innovation and bring much needed diversity into the sector.

Although applications were down on Q2, compared to Q1, they were up year on year.

Candidate availability was down in Q2 compared to Q1, for both permanent, temporary and fixed term contract candidates. This is in contrast to data reported by the Recruitment & Employment Confederations (REC), which indicates staff supply has continued to increase across England.

Download our latest Non-Profit Salary, Rewards and Retention Survey.

Our survey report for non-profit organisations and job-seekers, covers: